Cryptocurrency has become a popular topic in recent years, raising questions about its legal status and regulation in India. Understanding cryptocurrency law in India is essential for anyone interested in this digital currency.

Is cryptocurrency legal in India? Here, we will know about the current legal framework, regulatory challenges, and the future of cryptocurrency regulation in India. By examining these aspects, we aim to provide clarity on how the Indian government and regulatory bodies are addressing the rise of cryptocurrencies and what it means for users and businesses.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (like the Indian Rupee or US Dollar), cryptocurrencies operate on a technology called blockchain, which is a decentralized system spread across many computers that manage and record transactions.

This decentralization makes cryptocurrencies resistant to government control and interference.

The list of popular cryptocurrencies include:

- Bitcoin

- Ethereum

- Binance Coin

- Doge Coin

- Solana

- Litecoin

Suggested: Why Become a Lawyer in India?

Evolution of Cryptocurrency Law in India

Let’s talk about the history of cryptocurrency in India and its laws:

2010s: Introduction and Early Adoption

Bitcoin and other cryptocurrencies begin to gain attention among Indian tech enthusiasts and investors. Initial interest was driven by the potential for high returns on investment.

2013: RBI’s Initial Warning

The Reserve Bank of India (RBI) issues its first warning against the use of cryptocurrencies, highlighting potential risks.

2017: Increased Popularity and Government Attention

Between 2013 and 2017, there was a rapid increase in cryptocurrency trading and investment in India. The government formed an inter-ministerial committee to examine the regulation of virtual currencies.

2018: Banking Ban

RBI issues a circular prohibiting banks and financial institutions from providing services related to cryptocurrencies. The ban leads to a significant drop in trading volumes and the closure of several cryptocurrency exchanges.

2019: Draft Banning Bill

The inter-ministerial committee submits a draft bill proposing a complete ban on cryptocurrencies and recommending the introduction of an official digital currency. The draft bill is not passed, but it creates uncertainty in the market.

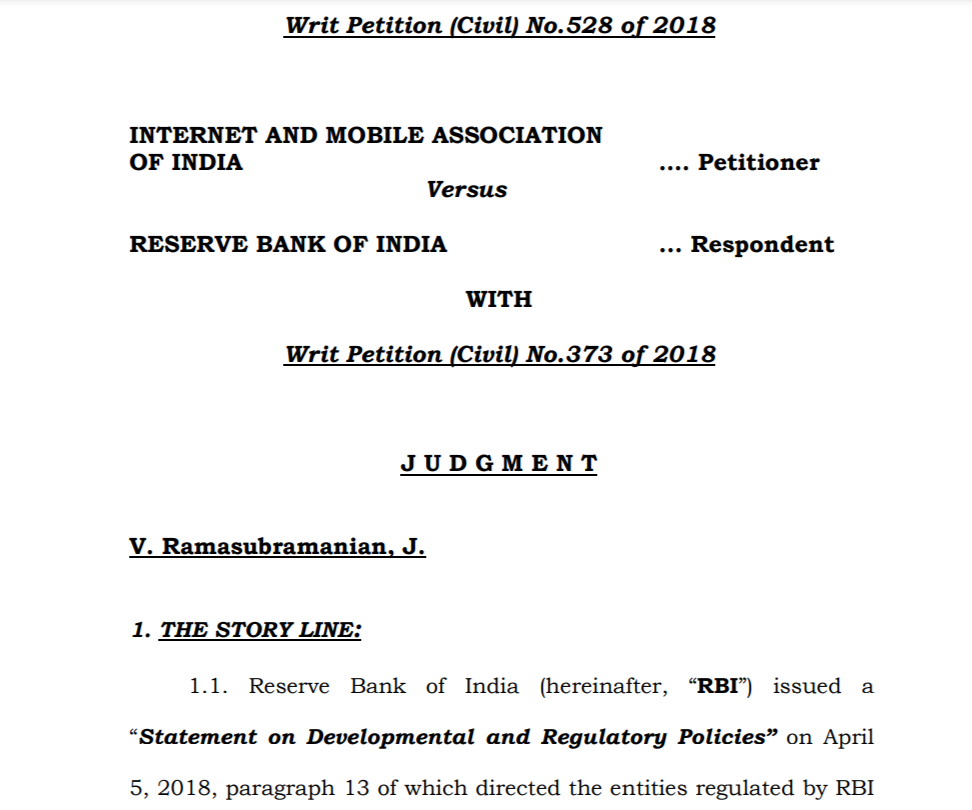

2020: Supreme Court Ruling

The Supreme Court of India overturns the RBI banking ban, allowing banks to provide services to cryptocurrency traders and exchanges again. This decision rejuvenates the cryptocurrency market in India.

2021: Renewed Interest and Regulatory Discussions

Significant increase in cryptocurrency investments and new exchange platforms emerging. The government introduces the Cryptocurrency and Regulation of Official Digital Currency Bill, aiming to create a framework for an official digital currency while considering restrictions on private cryptocurrencies.

Discussions on regulation have intensified, with ongoing debates about balancing innovation and security.

2022-2023: Regulatory Developments

- Continued efforts by the government to create a regulatory framework for cryptocurrencies.

- Focus on investor protection, preventing illicit activities, and exploring the potential of blockchain technology.

2024: Current Scenario

- Ongoing debates and evolving regulations.

- The cryptocurrency market remains active, with increased interest from both individual and institutional investors.

- The government continues to work on establishing clear guidelines for the use and regulation of cryptocurrencies in India.

Read Law-Related Blogs:

Difference Between Judge vs Magistrate

Difference Between Act and Law

Is Cryptocurrency Legal in India?

The legality of cryptocurrency in India has been a subject of significant debate and evolving policies. As of now, cryptocurrencies are not outright illegal in India. Individuals can buy, sell, and trade cryptocurrencies on various exchanges.

The Reserve Bank of India (RBI) has not recognized cryptocurrencies as legal tender, meaning they are not accepted as a medium of exchange for goods and services like the Indian Rupee.

The Indian government has expressed concerns about the potential misuse of cryptocurrencies for illegal activities, such as money laundering and financing terrorism. Despite these concerns, the government has not implemented a blanket ban on cryptocurrencies.

Instead, it has been exploring regulatory frameworks to address these risks while allowing for technological innovation.

The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, was introduced with the aim of creating a framework for the introduction of an official digital currency by the RBI and prohibiting private cryptocurrencies.

However, as of now, this bill has not been passed, and discussions and consultations are ongoing.

Suggested: Highest Paid Lawyers in India

Regulatory Challenges With Cryptocurrency Law in India

Regulating cryptocurrencies in India presents several significant challenges:

1. Legality and Recognition

- The lack of clear legal recognition and regulation creates uncertainty for users and businesses.

- Establishing a comprehensive legal framework that adequately addresses the unique nature of cryptocurrencies is complex.

2. Fraud Concerns

The unregulated market is prone to fraudulent schemes, Ponzi schemes, and other scams, which can exploit unsuspecting investors.

3. Financial Stability

- Cryptocurrencies are highly volatile, which can lead to financial instability and significant losses for investors.

- Large-scale adoption of cryptocurrencies could pose risks to the traditional financial system and monetary policy.

4. Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT)

The pseudonymous nature of cryptocurrency transactions can facilitate money laundering and the financing of illegal activities. Ensuring compliance with AML and CFT regulations is challenging due to the decentralized and cross-border nature of cryptocurrencies.

5. Consumer Protection

Protecting consumers from the risks associated with cryptocurrency investments, such as fraud and market volatility, is crucial. Raising awareness and educating investors about the risks and benefits of cryptocurrencies is essential for informed decision-making.

6. Global Coordination

The global nature of cryptocurrencies requires international cooperation and coordination to address regulatory challenges effectively. Ensuring consistency and harmonization of regulations across jurisdictions is important to prevent regulatory arbitrage.

Tax on Cryptocurrency in India

In India, you pay a 30% tax on profits from trading, selling, or spending cryptocurrencies. Additionally, a 1% Tax Deducted at Source (TDS) applies to crypto sales exceeding ₹50,000 (₹10,000 in certain cases) per financial year. Non-trading income in crypto is taxed at individual slab rates.

Relevant Provisions:

115BBH and 194S deal with the taxation of Virtual Digital Assets (VDAs), including cryptocurrencies, NFTs, tokens, etc.

Key Tax Rates:

- Flat Tax on Profits: 30% tax on profits from trading, selling, or spending cryptocurrencies.

- TDS: 1% Tax Deducted at Source (TDS) on the sale of crypto assets exceeding ₹50,000 (₹10,000 in certain cases) in a single financial year.

Income Tax on Non-Trading Income:

Income tax at your individual slab rate for earnings in crypto from activities like staking, airdrops, or mining.

Taxable Transactions:

- Selling crypto for INR or other fiat currencies.

- Trading one cryptocurrency for another, including stablecoins.

- Spending crypto on goods and services.

Government Acknowledgement:

In the 2022 Budget, the Indian government recognized cryptocurrencies as Virtual Digital Assets (VDAs) and introduced a taxation framework for them.

Also Read:

FAQs About Cryptocurrency Law in India

Cryptocurrency is not recognized as legal tender in India, but it is not illegal to buy, sell, or hold cryptocurrencies. The Supreme Court overturned the RBI’s ban on banking services for cryptocurrency transactions in March 2020, allowing banks to provide services to cryptocurrency businesses and traders.

Cryptocurrency is currently not comprehensively regulated in India. While there are some guidelines related to KYC, AML, and taxation, a detailed regulatory framework is still under development. The government is actively working on establishing clearer regulations.

Cryptocurrency is not banned in India. Although the RBI had issued a circular in 2018 prohibiting banks from providing services related to cryptocurrencies, this ban was overturned by the Supreme Court in March 2020. Currently, cryptocurrencies can be traded and held legally.

The RBI’s 2018 ban on cryptocurrency-related banking services was driven by concerns over financial stability, investor protection, and the potential use of cryptocurrencies for illegal activities such as money laundering and financing terrorism. The RBI aimed to mitigate these risks through the ban.

Cryptocurrencies were effectively legalized in March 2020 when the Supreme Court of India overturned the RBI’s 2018 circular that prohibited banks from providing services related to cryptocurrencies. This ruling allowed banks to resume services to cryptocurrency exchanges and traders.

Yes, individuals and businesses must disclose their cryptocurrency holdings and transactions in their income tax returns. Companies must also disclose cryptocurrency holdings in their financial statements as mandated by the Ministry of Corporate Affairs.

The Reserve Bank of India (RBI) is exploring the introduction of a Central Bank Digital Currency (CBDC), which would be a digital version of the Indian Rupee. Pilot programs and phased implementation strategies are being considered.

Cryptocurrencies are not recognized as legal tender, meaning they cannot be used as a medium of exchange for goods and services like the Indian Rupee. However, individuals can still use cryptocurrencies for transactions between consenting parties.

Non-compliance with tax reporting and disclosure requirements can result in penalties and legal action. Regulatory authorities like the Income Tax Department and the Enforcement Directorate actively monitor cryptocurrency transactions for compliance.

Read Next: